how much federal tax is taken out of my paycheck in illinois

Assuming a top tax rate of 37 heres a look at how much youd take home after taxes in each state and Washington DC if you won the 19 billion jackpot for both the lump. Use this tool to.

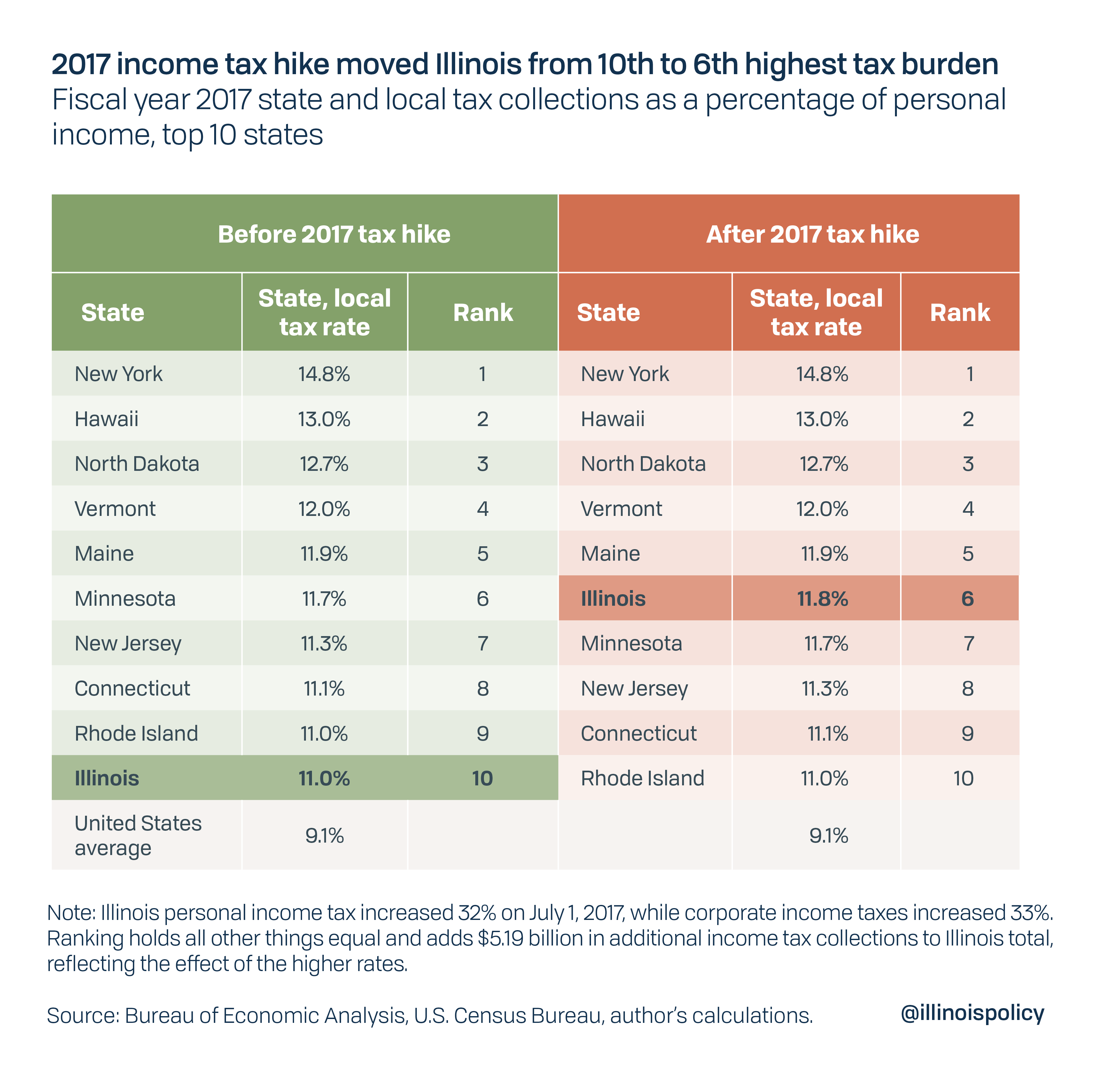

Illinois Passed A Record Breaking Income Tax Hike 3 Years Ago Here S Where The Money Went

November 7 2022 657 AM PST.

. These amounts are paid by both employees and employers. This calculator is a tool to estimate how much federal income tax will be withheld. How Much Federal Tax Is Taken Out Of My Paycheck In Illinois.

Illinois Hourly Paycheck Calculator. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator. Our calculator has recently been updated to include both the latest Federal Tax Rates.

How much is 75k after taxes in. This is a projection based on information you provide. The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022.

If you are married but would like to withhold at the higher single rate. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. The state tax year is also 12 months but it differs from state to state.

What percentage is taken out of paycheck taxes. 2022 Federal Tax Withholding Calculator. These are the rates for.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The Powerball jackpot is a record 204 billion.

FICA taxes consist of Social Security and Medicare taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. There are seven federal tax brackets for the 2022 tax year.

You can even use historical tax years to figure out your total salary. Illinois Salary Paycheck Calculator. Some states follow the federal tax.

For 2022 employees will pay 62 in Social Security on the. How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might. See how your refund take-home pay or tax due are affected by withholding amount.

495Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495. Your household income location filing status and number of personal. And North Carolina taxes any lottery winnings over 600 as income.

Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. Estimate your federal income tax withholding. How Much Taxes Is Taken Out Of A Paycheck In Illinois.

How It Works. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Winners will be hit with a massive tax bill if they live in these states. So the tax year 2022 will start from July 01 2021 to June 30 2022.

For 2022 the individual income tax rate is 499 which means the lottery would withhold about 46362090. 10 12 22 24 32 35 and 37. You are able to use our Illinois State Tax Calculator to calculate your total tax costs in the tax year 202223.

The wage base is. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing. Your bracket depends on your taxable income and filing status.

Illinois tax year starts from july 01 the year before to june 30 the current year.

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Why Does My Federal Withholding Vary Each Paycheck

:max_bytes(150000):strip_icc()/GettyImages-646424806-1278847b0c7748b5833c3245cd82b287.jpeg)

Illinois Income Tax Agreement With Bordering States

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Tax Filing Without The Headaches Illinois Earned Income Tax Credit Simplified Filing Pilot

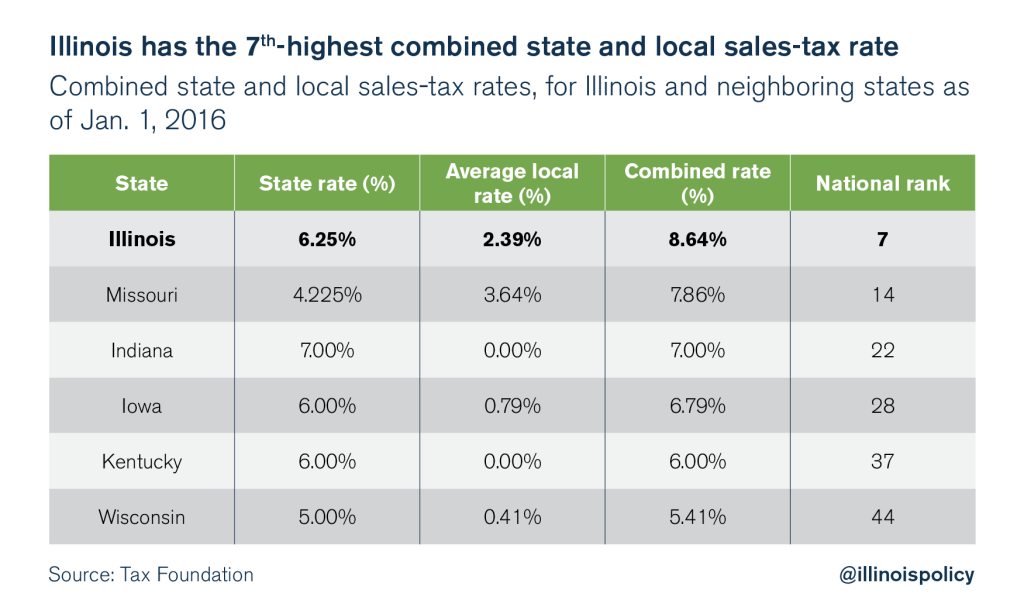

Illinois Tax Rates Rankings Illinois State Taxes Tax Foundation

Time To Revisit Your Pay Stubs California Peculiarities Employment Law Blog

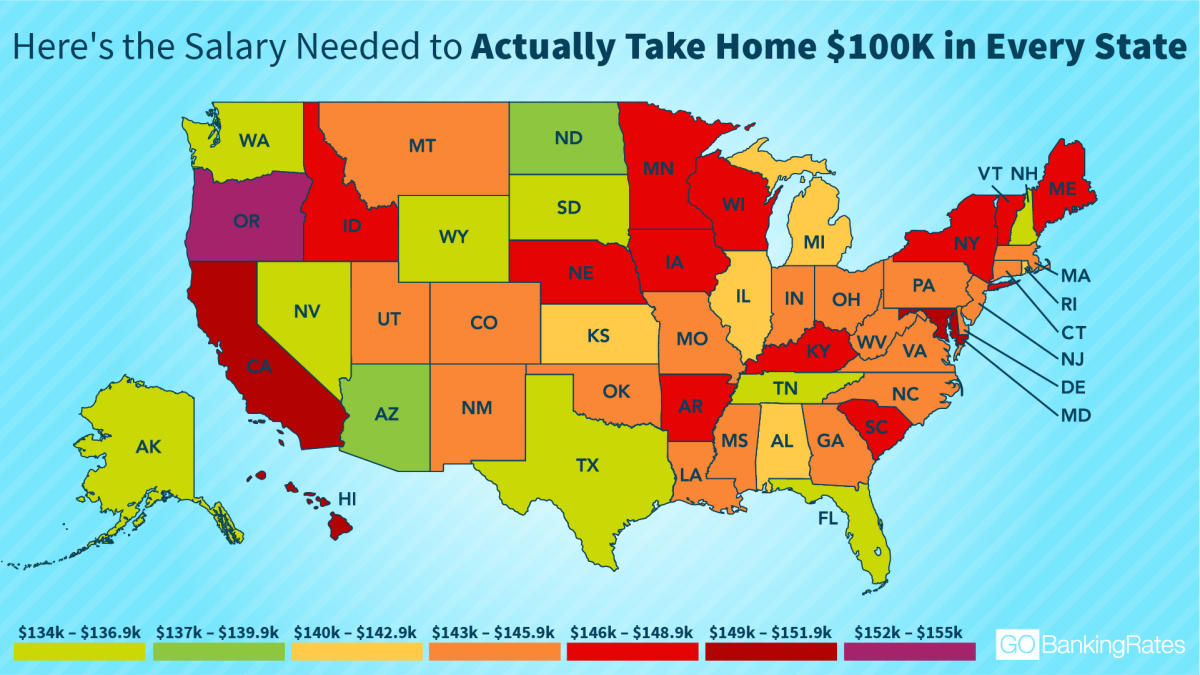

This Is The Ideal Salary You Need To Take Home 100k In Your State

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Illinois Paycheck Calculator Smartasset

Illinois Is A High Tax State Illinois Policy

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Bain Associates Llc Payroll Tax Accounting Services Benton Il